Are Office Parties Tax Deductible . learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. learn what types of meal and entertainment expenses are 100% deductible on a business return, such as office. learn how to follow the irs rules to write off your business party or event expenses. learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. Find out the conditions and benefits of. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn how to report and pay national insurance and tax for social functions and parties for your employees. Find out who qualifies, what counts as a relevant business.

from backyardworkspace.com

learn how to follow the irs rules to write off your business party or event expenses. learn how to report and pay national insurance and tax for social functions and parties for your employees. learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. Find out who qualifies, what counts as a relevant business. Find out the conditions and benefits of. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn what types of meal and entertainment expenses are 100% deductible on a business return, such as office.

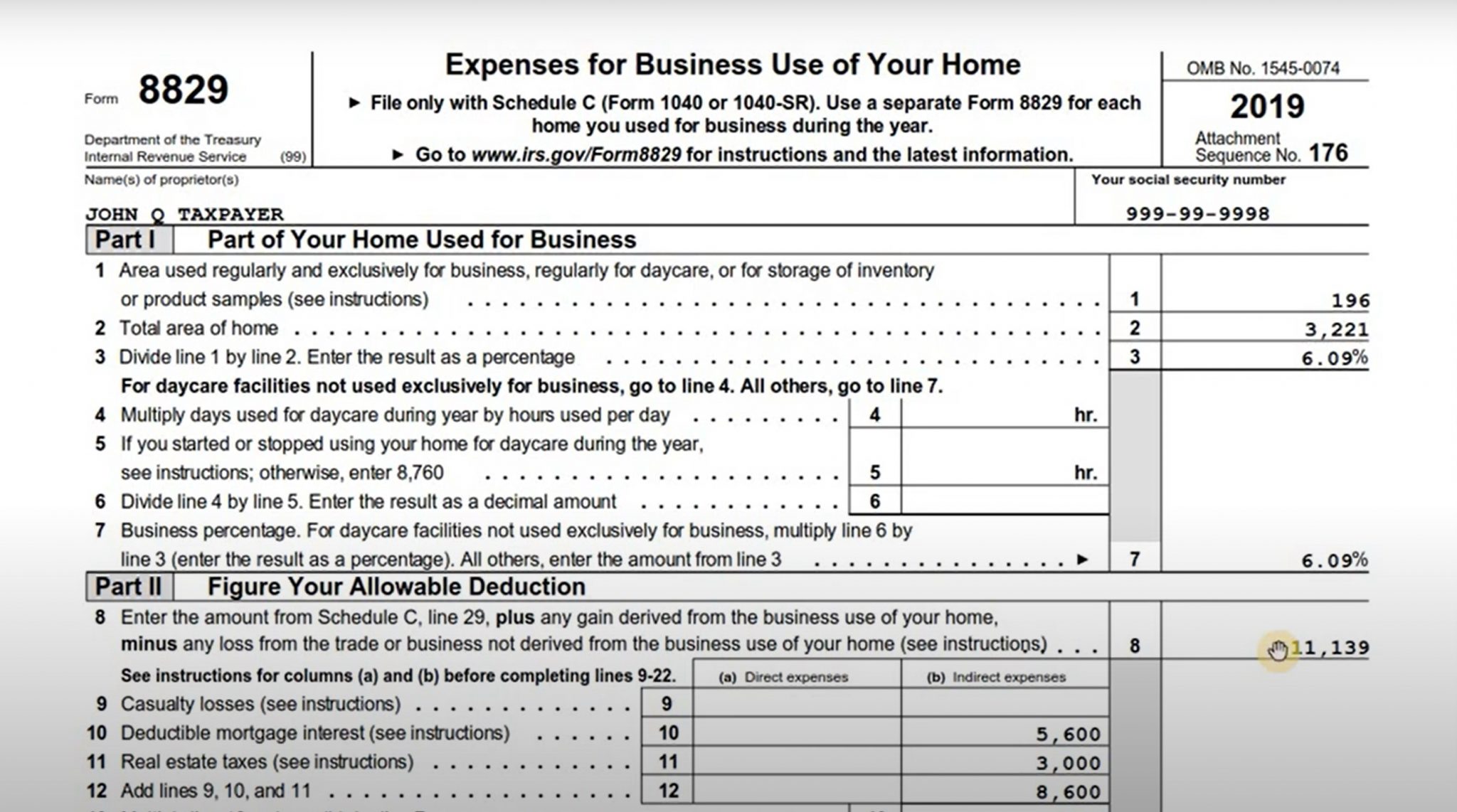

Is A Home Office Tax Deductible? File Smarter in the US, UK, or Canada

Are Office Parties Tax Deductible learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. learn how to report and pay national insurance and tax for social functions and parties for your employees. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. learn what types of meal and entertainment expenses are 100% deductible on a business return, such as office. Find out who qualifies, what counts as a relevant business. learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. learn how to follow the irs rules to write off your business party or event expenses. Find out the conditions and benefits of.

From www.thesait.org.za

Tax Deductable Business Expenses SA Institute of Taxation Are Office Parties Tax Deductible learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. Find out the conditions and benefits of. learn how to report and pay national insurance and tax for social functions and parties for your employees. learn how to follow the irs rules to write off your business party or event expenses. . Are Office Parties Tax Deductible.

From www.pinterest.com

Is Office Furniture Tax Deductible? Tax deductions, Business tax Are Office Parties Tax Deductible learn how to report and pay national insurance and tax for social functions and parties for your employees. Find out the conditions and benefits of. learn how to follow the irs rules to write off your business party or event expenses. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. . Are Office Parties Tax Deductible.

From ibissandco.com

Are Staff Parties Tax Deductible in the UK? IBISS & Co Are Office Parties Tax Deductible learn how to report and pay national insurance and tax for social functions and parties for your employees. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. Find out the conditions and benefits of. learn how to follow the irs rules to write off your business party or event expenses. . Are Office Parties Tax Deductible.

From porttalk.co.uk

How to ensure your office Christmas party is taxdeductible Porttalk Are Office Parties Tax Deductible learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. Find out the conditions and benefits of. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. Find out who qualifies, what counts as a relevant business. learn what types of meal and. Are Office Parties Tax Deductible.

From www.simplimd.com

Is That Deductible? "The Office Christmas Party" Are Office Parties Tax Deductible learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. Find out the conditions and benefits of. Find out who qualifies, what counts as a relevant business. learn. Are Office Parties Tax Deductible.

From www.jotform.com

Tax Deduction Letter Sign Templates Jotform Are Office Parties Tax Deductible Find out who qualifies, what counts as a relevant business. learn what types of meal and entertainment expenses are 100% deductible on a business return, such as office. Find out the conditions and benefits of. learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. learn how to. Are Office Parties Tax Deductible.

From irstaxtrouble.com

Party Like its 2017 Deductible Entertainment Expenses Are Office Parties Tax Deductible learn what types of meal and entertainment expenses are 100% deductible on a business return, such as office. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn how to follow the irs rules to write off your business party or event expenses. learn how to claim a tax deduction. Are Office Parties Tax Deductible.

From www.tspaccountants.com.au

Christmas Questions! Staff Parties & Gifts! What Is Deductible? TSP Are Office Parties Tax Deductible learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. Find out the conditions and benefits of. learn how to determine the tax deductibility of general expenses incurred in the performance of. Are Office Parties Tax Deductible.

From www.youtube.com

Is My Home Office Tax Deductible? YouTube Are Office Parties Tax Deductible Find out who qualifies, what counts as a relevant business. Find out the conditions and benefits of. learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. learn how to report and pay national insurance and tax for social functions and parties for your employees. learn how to. Are Office Parties Tax Deductible.

From mazumausa.com

Is Office Furniture Tax Deductible? Mazuma Are Office Parties Tax Deductible learn how to follow the irs rules to write off your business party or event expenses. learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn how to determine the. Are Office Parties Tax Deductible.

From smallbiztrends.com

How to Deduct Your Office Costs Small Business Trends Are Office Parties Tax Deductible learn what types of meal and entertainment expenses are 100% deductible on a business return, such as office. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. Find out the conditions and benefits of. learn how to report and pay national insurance and tax for social functions and parties for your. Are Office Parties Tax Deductible.

From www.zenturaworkspace.co.uk

Are Office Refurbishments Tax Deductible in 2023? Zentura Are Office Parties Tax Deductible learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn how to follow the irs rules to write off your business party or event expenses. Find out the conditions and benefits of. learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports. Are Office Parties Tax Deductible.

From www.stkittsvilla.com

Can You Take A Home Office Tax Deduction Virblife Com Are Office Parties Tax Deductible learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. Find out who qualifies, what counts as a relevant business. learn how to claim a tax deduction for a staff christmas party or. Are Office Parties Tax Deductible.

From taxcare.org.uk

Are Company Christmas Parties Tax Deductible? Taxcare Accountant Are Office Parties Tax Deductible Find out who qualifies, what counts as a relevant business. Find out the conditions and benefits of. learn what types of meal and entertainment expenses are 100% deductible on a business return, such as office. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn how to follow the irs rules. Are Office Parties Tax Deductible.

From pruscpa.com

Employee Recreation And Parties Survive TCJA Tax Reform » GP CPA P.C. Are Office Parties Tax Deductible learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. learn how to report and pay national insurance and tax for social functions and parties for your employees. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. Find out who qualifies, what. Are Office Parties Tax Deductible.

From www.in-accountancy.co.uk

Tax Deductible Office Party?? INAccountancy Are Office Parties Tax Deductible learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. Find out who qualifies, what counts as a relevant business. learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. learn how to report and pay national insurance. Are Office Parties Tax Deductible.

From polstontax.com

The Employer's Guide to Deducting Company Holiday Party Expenses Are Office Parties Tax Deductible learn how to determine the tax deductibility of general expenses incurred in the performance of the duties of employment. learn how to provide free or subsidised meals, meal vouchers, client entertainment expenses and seasonal. learn how to follow the irs rules to write off your business party or event expenses. Find out the conditions and benefits of.. Are Office Parties Tax Deductible.

From backyardworkspace.com

Is A Home Office Tax Deductible? File Smarter in the US, UK, or Canada Are Office Parties Tax Deductible learn how to claim a tax deduction for a staff christmas party or other inclusive events, such as sports days. Find out who qualifies, what counts as a relevant business. learn what types of meal and entertainment expenses are 100% deductible on a business return, such as office. learn how to report and pay national insurance and. Are Office Parties Tax Deductible.